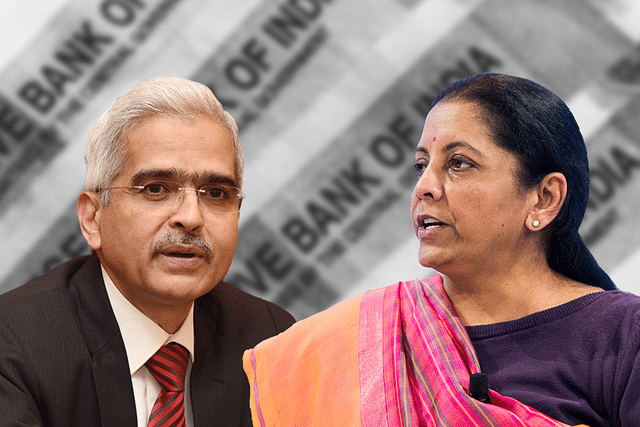

Fiscal Stimulus By The Government Will Hold The Key But Here Are 6 Things That RBI Governor Shaktikanta Das Can Do Now

The RBI wants to keep the powder dry but a deluge is right now sweeping the globe.

While the government readies a fiscal action plan, the RBI can lend a helping hand over the next couple of weeks.

As the world stares at sudden and unforeseen economic slowdown in the wake of the coronavirus spread, Indian economy is also being impacted as the pandemic unfolds.

The real impact on the gross domestic produce (GDP) will not be known until Q4 Financial Year (FY) 2019-20 numbers come out, which will happen only end-May. These numbers will reflect the business activity collapse in March, but won’t capture the full blow of the pandemic. The Q1 FY 2020-21 GDP data will tell the real story, but that data will be available only end of August.

With the impending crisis but long data collection timelines, none of these numbers are going to guide what needs to be done right away. India today needs a fiscal stimulus as well as a Reserve Bank of India (RBI) intervention immediately to make sure that economy does not grind to a screeching halt in April, the first month of FY 2020-21.

The fiscal measures will be in focus as they should be and cannot be replaced by anything which Reserve Bank Of India (RBI) takes up. However, the RBI itself has a key role to play here. The central bank has already undertaken a few measures, but these do not appear to be very impactful as yet.

On March 16, RBI Governor Shaktikant Das held a press conference and announced two key measures. The bank conducted a $2-billion forex swap to ensure there are no dollar shortages in the markets as Foreign Institutional Investors (FIIs) continue to pull out money from the Indian markets. A Long Term Repo Operation (LTRO) was also announced to help reduce bond yields. But the markets were expecting much more from the RBI, given that US Fed had cut rates out of turn for the first time since the Global Financial Crisis.

On March 18, the RBI announced a fresh round of Open Market Operations (OMO), to cool down tightening bond yields and reduce spreads. While this announcement led to the benchmark 10-year Government of India bond yield falling 11 basis points intra-day, the quantum of the OMO at Rs. 10,000-crore may not really be sufficient to keep the financial conditions from tightening again.

There are two unrelated issues for the RBI to address. Coronavirus impact is obviously one of them. But on March 18, another issue propped up, where the government will need assistance from the RBI.

In the telecom sector Adjusted Gross Revenue (AGR) case, the Supreme Court bench refused to acknowledge the dues calculated by the telecom companies. While there has been no decision on the government’s proposal to space out the payments over twenty years, the Court made it clear that the amount cannot be re-calculated or re-interpreted.

With the high level of debt Vodafone Idea carries, Indian banks maybe looking at another fresh wave of Non-Performing Assets (NPAs) building up. This situation will get amplified due to the potential NPAs due to the impending economic slowdown. The banks’ position may be protected if the Supreme Court accepts the government proposal for deferred payment of adjusted gross revenue (AGR) dues. But if that does not happen on the next hearing date, several banks will come under pressure. In soft operating environment, the RBI has to doubly ensure that no private or public bank seeing deposit flight due to panic and irrationality.

Hence while the need for fiscal stimulus is well recognized, the RBI on its part needs to bring more firepower to the table.

Firstly, the RBI should announce big OMO (Open Market Operations) for three months upfront. The quantum has to be closer to Rs. 50000-crore per month, with the assurance that the OMOs will continue beyond three months if required. Keeping the Indian bond yields in check is important right now. The government will itself revisit its borrowing program very soon to make way for a potential fiscal stimulus.

Secondly, The RBI should quickly identify the sectors likely to be most hit by the coronavirus scare. These sectors plus telecom, should be given an NPA recognition relief, where banks are not forced to classify accounts as NPAs immediately. Aviation, Hospitality, Retail and Travel are some of the most obvious candidates.

Thirdly, if the RBI gets a whiff of any private bank coming under stress, it should ensure that clear communication is made before any adverse event telling the market that the bank won’t be allowed to go under water. A joint communication by the government, the RBI and any bank under stress itself will go a long way in checking the spread of rumours.

Fourthly, the RBI should commit to hiring a few , if not more, specialists – lawyers and accountants – to run a broad-based surveillance and supervision program. This will ensure that any weak links in the financial system are identified early and acted upon before the institution collapses.

Fifthly, once the Banking Regulation Act is amended by the Parliament, expected to happen in the ongoing Budget session, the RBI should launch a program to identify and isolate weak cooperative banks. The amendment to the act will give the RBI wider powers of supervising these cooperative banks, which continue to cause uncannily regular stress in the financial system.

Sixthly, the RBI must get better at communication. On March 16 when the central bank called for a press conference, there was wide-ranging anticipation that the RBI will cut rates without waiting for the scheduled Monetary Policy Committee (MPC) meeting in April. Instead, the press conference talked about the Yes Bank revival and an insufficient LTRO and dollar-rupee swap only. If the rate cuts were not on agenda, the RBI could have clarified that when the press conference was called.

Lastly, rate cuts! Critics of the government stress that rate cuts are in themselves not sufficient because managed rates on small saving schemes continue to be 100 basis points over the equivalent banks rates and hence transmission is an issue. That point is well taken and valid – the government has to cut administered rates on all small saving schemes in a meaningful way, when the businesses and business activity come back up over the next couple of months, small firms will need immediate credit. The economy will need a booster dose of big-ticket demand like real estate. Even if RBI cuts by 100 basis points and only 50 basis points get transmitted, it will still help on the demand-side.

Indian foreign exchange reserves are at an all time high, economy is beset with deflationary impulses despite upside blips in the last couple of months and central banks world-over are looking at immediate rate cuts – some like US Fed have already acted. The RBI wants to keep the powder dry but a deluge is right now sweeping the globe.

While the government readies a fiscal action plan, the RBI can lend a helping hand over the next couple of weeks.