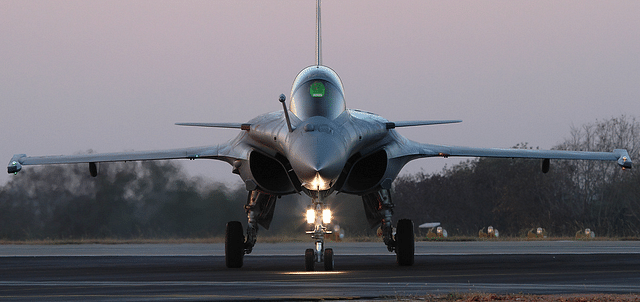

Rafale Deal: New Details Emerge About Four Billion Euro Make In India And Offsets Plan

The Narendra Modi government has come out with more information about the Rafale deal.

It also clears the air on allegations over whether Cabinet Committee on Security was in the loop on the deal.

As a political storm intensifies around India’s 7.87 billion euro deal for 36 Rafale fighter jets from France, and substantial fire focused through allegations of preferential corporate partnerships for the 4 billion euro in offsets that Dassault Aviation and its partners need to execute, the Narendra Modi government today (13 March) pushed out more information by way of an answer in Parliament.

The answer not only republished cost figures, with the important disclaimer that these figures did not take into account the cost of India-specific modifications, weapons and other services, but also cleared the air on allegations over whether India’s apex Cabinet Committee on Security was in the loop on the Rafale deal.

But as the government prepares to fight off in Parliament what appears to be a dogged opposition attack on the deal, Livefist has obtained access to the first comprehensive details of France’s plans on what will easily be the most challenging component of the Rafale deal: the offsets. Offsets involve investments and sourcing that companies manufacturing the Rafale must make in India amounting to half of the deal’s 7.87 billion euros value. The offsets are to be executed within seven years from the time the deal was signed – by 2023, that is.

In a series of slides accessed by Livefist, the contours of the ‘Make in India’ elements of the Rafale deal stand revealed for the first time. The details that follow pertain principally to the Rafale platform itself, and doesn’t include the $1-billion partnership between France’s SAFRAN and India’s DRDO for the Kaveri turbofan engine, a major thrust area for both countries that will also count in the offsets programme.

The details below reveal that Rafale has so far forged partnerships with at least 72 firms for industrial sourcing areas that span, among other Dassault platforms, the Rafale’s airframe, its Snecma M88 engines, radar, electronic warfare and avionics, aeronautical components, engineering and software. The slides below indicate that Dassault and its partners are in negotiations with tens more firms for offsets opportunities. This, in effect, is the first specific and overall sense of what Indian firms will bring to the table on the Rafale.

This first overview of an offsets execution plan is especially of interest, given that India’s offsets policies are widely regarded by international vendors and governments as convoluted, self-defeating, or, in the words of one prominent chief executive officer, “a godawful mess”.

In Parliament yesterday (12 March), India’s Minister of State for Defence Subhash Bhamre said, “the quantum of offsets in the Inter-Governmental Agreement for 36 Rafale fighter jets is 50 per cent, which includes investments in terms of Transfer of Technology for manufacture and maintenance of eligible products and services. The current offsets policy of the Defence Procurement permits the vendors to provide details of their Indian Offset Partners either at the time of seeking offset credits or one year prior to discharge of offset obligations. Vendor/Original Equipment Manufacturers (OEM) is free to select his Indian Offset Partner.”

The first slide, pertaining to airframe offsets and sourcing, lists the Dassault-Reliance joint venture firm (DRAL) as being part of a group of companies that will produce mechanical parts and sub-assemblies. Other companies in this list include Indian majors like L&T, the Mahindra Group, the Kalyani Group and Godrej & Boyce.

Marked in red are joint venture companies that Dassault and its partners have already incorporated in India, in part, to execute the Rafale deal offsets. Apart from the Dassault Reliance JV, the others include Snecma HAL Aerospace Ltd for aero-engine components and Thales’s joint ventures with India’s SAMTEL for multifunction cockpit displays. The new Thales-Reliance joint venture, named Thales Reliance Defence Systems, not only plans to build technologies for Rafales in India and worldwide, but also says it will ‘develop Indian capabilities to integrate and maintain radar and electronic warfare sensors’.

The details revealed today by Livefist add substantially to the level of detail of a conversation that has so far involved much political cloak and dagger from both the government as well as the opposition. The French president departed yesterday after a four-day visit deemed mostly successful on the strategic front, though India notably declined a specific request from the highest levels of the French government to send out a message, while President Emmanuel Macron was in Delhi, that the two countries were in discussions for 36 more Rafale jets.

Here’s more from the Rafale offsets plan and the Indian companies that will be part of it.

Rafale deliveries to the Indian Air Force begin in September 2019.

This article was first published on Livefist Defence.Com and has been republished here with permission.