Banking The Unbanked: How Modi’s Jan Dhan Revolution Has Benefited Millions Of India’s Poor

Launched merely three years ago, the mission to provide no-frills, no-minimum-balance bank accounts to every adult has been remarkably successful.

Here’s a summary of India’s progress towards providing universal financial access.

Financial inclusion – providing universal access to financial services and encouraging their use – is an important means for promoting economic development. As of 2014, the World Bank estimated that there were still two billion adults without a bank account, and many others with only a tenuous connection to the financial system (see Global Findex). Better access will boost the efficiency of the payments system, promote household savings and access to credit, and improve people’s ability to manage risk. And, as it does all of these things, financial inclusion has the potential to reduce inequality and increase economic growth. In other words, reducing the multitudes of those that are unbanked will improve the fate of the poorest of the poor. (For more detail, see our earlier post.)

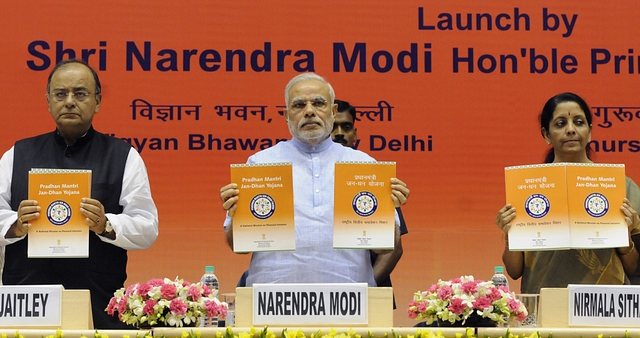

India’s unprecedented effort to “bank the unbanked” through the Pradhan Mantri Jan Dhan Yojana (PMJDY), or “Prime Minister’s People’s Wealth Scheme,” is by far the largest such undertaking. Launched merely three years ago, on 28 August 2014, the mission to provide no-frills, no-minimum-balance (hereafter, JDY) bank accounts to every adult (including the one-fifth of the population living below the poverty line and the large rural population with limited access to physical bank branches) has been remarkably successful. As of this writing, more than 300 million people have opened JDY accounts. And, while initial readings suggested limited use, over time, JDY account holders look to be learning about the benefits, so that the use is rising towards levels observed for bank accounts of comparable individuals. Put differently, by lowering bank transaction costs, hundreds of millions of people who lacked access to financial services are revealing a latent demand.

Many previous efforts to reduce the ranks of the unbanked have been far less effective (see, for example, Dupas et al). Consequently, a great deal of research is still needed to understand exactly which characteristics of the Indian programme have been key to its success. Is it the country’s unique 12-digit biometric identification (Aadhaar) issued to over 99 per cent of adults that facilitates account opening and limits fraud? Is it the government’s effort to digitise payments, including benefits transfers that can be distributed through these accounts? Is it the ability of the government to use a largely public sector banking system to advance a possibly unprofitable national mission? Is it the thousands of new bank agents engaged to encourage account opening and use in rural villages? Is it added benefits (such as insurance and overdraft privileges) associated with the accounts? Is it the national scale that creates a range of favourable network effects (such as facilitating remittances across long distances)?

And what about side effects? To what extent are new accounts duplicates? Will the lack of financial literacy lead to fraud or abuse of the new account holders? Will account use wither in the absence of government transfer remittances? Does the system require continuous subsidies to survive?

Most of these questions remain only partly answered. In this post, we summarise India’s progress towards providing universal financial access and highlight the conclusions of recent research – which use both direct measurement of accounts as well as survey data.

Let’s begin with a few facts. As of 2011, prior to the start of the JDY programme, the World Bank reports that only 35 per cent of Indian adults had a bank account. By 2014 (which included the first few months of the JDY programme), that share had risen to 53 per cent. Even then, however, only 22 per cent had a debit card, only 14 per cent had accumulated savings at financial institutions (compared to 38 per cent who had any savings at all), and no more than 4 per cent used an account in the previous year to receive wages, receive government transfers, or pay utility bills. Similarly, while 46 per cent had borrowed money over the past year, only 6 per cent had done so through a financial institution. Finally, the share of women owning an account (43 per cent) was far below the adult norm.

In other words, only a very small percentage of the Indian population used the sorts of banking services that most of us benefit from nearly every day.

Where do Indians stand today? Fortunately, information about the JDY accounts means that we don’t need to wait for the World Bank’s triennial Global Findex (due out next spring) to find out.

As of 25 October 2017, just over three years from the start of the programme, India’s banks had opened 305 million JDY accounts. Of these, 60 per cent were in rural and semi-urban areas (see table and chart). And, account deposits currently total Rs 671 billion (more than $10 billion). Consistent with India’s banking system structure, most of these accounts and deposits are in public sector banks.

India, JDY Accounts, 25 October 2017

India, JDY accounts: Share of positive-balance accounts (percent, left)) and number of accounts (millions, right)), September 2014-October 2017

Considering that JDY accounts are designed to promote access for people with lower incomes, it is unsurprising that they constitute less than 1 per cent of the Rs 108 trillion total of demand and time deposits. However, when compared with the rural monthly income at the poverty line of Rs 816 (or Rs 1,000 in urban areas), today’s average JDY deposit of Rs 2,200 seems substantial. Interestingly, the bottom quintile of US households have mean monthly income of $1,200 and average transactions assets of $3,200 – a comparable ratio. (See the 2016 Survey of Consumer Finances, tables 1 and 6.)

Together with the JDY deposits, Indian banks have provided 230 million debit cards to facilitate electronic payments. In rural areas, beyond the reach of bank branches, a new array of village-level bank agents who helped open accounts also have equipment to take deposits, as well as transfer remittances and make payments (see the Microsave assessment of their performance). One review of multiple surveys suggests that JDY account holders view these agents as more helpful than ATMs, which may not be as local (or, perhaps, not as trusted; see Günther).

Since the JDY program began three years ago, an increasing share of JDY accounts has been associated with an Aadhaar ID. A late 2015 survey, one year after the start of the programme, found that 62 per cent of JDY accounts were Aadhaar-linked. By reducing documentation requirements, Aadhaar IDs made it both easier to open accounts and to transact. Chopra et al add that Aadhaar-linked accounts are less vulnerable to manipulation (think Wells Fargo!). They also note that banks which opened more accounts also saw more transactions – consistent with a genuine demand for banking services, rather than a mirage of supply. (In its continuing efforts to combat money laundering, the Indian government announced in June that all bank accounts – not just JDY accounts – must be Aadhaar-linked by end 2017.)

To document usage of accounts, the government initially tracked the share of JDY accounts with a zero balance. Based on this data, the positive-balance share rose from less than one-fourth in September 2014 to about three-fourths today (see black line in chart). Unfortunately, this measure reveals little about the intensity of account usage. How large and frequent are the transactions? How do account balances vary over time? Moreover, such measures are subject to manipulation by banks wishing to appear successful in supporting a mission of national importance (see, for example, here).

Turning to recent research on the subject, two major studies compare actual bank JDY account data to that of a control group (either generally higher-income customers who started accounts over the same time period, or comparable customers who created accounts earlier). Focusing on several thousand JDY accounts from four branches of a public sector bank, Chopra, Prabhala and Tantri track usage for seven quarters (until just before India’s demonetisation in November 2016). Agarwal et al exploit a much larger sample – including more than 1.5 million JDY accounts – but the tracking period ends significantly earlier (in May 2015, or just 10 months after the programme began).

Importantly, the principal findings of the two papers are largely consistent with one another. Initially, both sets of researchers observe relatively little usage of the new accounts. For example, Agarwal et al report that fewer than one-fifth of JDY account holders make a deposit in the first six months, and the share-making withdrawals is substantially lower (see figure 2). Similarly, Chopra et al find that the unbanked display “significant static friction” when they open a JDY account.

However, both papers highlight evidence that, as account holders learn about banking services, latent demand surfaces. Here are some of the key observations:

- JDY accounts show increasing activity with account age, consistent with an experiential learning process. According to Chopra et al, transactions per quarter nearly double to an average of 1.1 by the seventh quarter after accounts are opened. The gap in frequency of transactions with the control group also shrinks over time. Similarly, ATM transactions increase over time in JDY accounts, but not in other accounts. Agarwal et al also report a sharper upward trend in the number of deposits and withdrawals in JDY accounts, compared with that in non-JDY accounts.

- JDY accounts build balances over time that are economically meaningful for poor households. According to Chopra et al, balances rise both in accounts that receive government transfers and those that do not. In contrast, the results of analyzing balances in non-JDY accounts are mixed. Similarly, Agarwal et al report a larger upward trend in JDY balances than in non-JDY accounts.

- Exploiting regional differences, Agarwal et al observe that districts with a larger unbanked share prior to the JDY program display both greater account creation and a greater amount deposited. These regions also exhibit a relatively larger increase in the number and amount of loans granted. This last finding is consistent with the notion that the JDY program helps overcome asymmetric information in the provision of credit to satisfy previously unmet demand.

Survey findings assessed by Günther add the following (see Table 17):

- JDY narrowed the gender gap: in 2015, the probability of obtaining an account was 6 per cent higher for a female than a male. By contrast, in 2013 (prior to JDY), the probability was 7 per cent lower.

- JDY narrowed the urban-rural gap: in 2015, a rural person was 5 per cent more likely to obtain an account than an urban dweller, reversing a 6 per cent disadvantage in 2013.

- JDY improved account access for people below the poverty line.

Collectively, these results point to sizeable gains for India’s poor from the JDY programme. To be sure, the programme’s overall impact on aggregate welfare is difficult to assess. A key reason is that the costs of establishing and maintaining JDY accounts are not observable. Even leaving aside broader opportunity costs, the direct peak-load costs of introducing many accounts rapidly – 15 million accounts were opened on the first day – were probably substantial for the banks. Consequently, the willingness of public sector institutions to comply with state priorities may have played (and may still play) a significant role in the JDY programme’s success.

But these costs can be balanced against what could be large benefits for the society as a whole. Among other things, shifting from cash to electronic transfers reduces the opportunity for both cash-based black-market activity, and for “leakage” – the tendency for only a part of a government benefit payment to find its way to the intended recipient. This alone could be sufficient to offset the origination costs of JDY accounts.

It remains of key importance for policymakers elsewhere to understand the sources of the JDY programme’s success. The extraordinary features of this effort – including not only no-frills accounts but also the extensive involvement of national leadership, the provision of unique biometric IDs, the advent of government digitised transfer payments, and the introduction of rural bank agents – would seem quite difficult to simulate in a small (or even a relatively large) randomised control trial (RCT) that facilitates welfare assessment.

RCTs are rightfully now the gold standard among economists for analysis of policy programmes, and proponents have made promising suggestions about how to address scalability issues arising in the transition from successful trials that are relatively small to broad-based programmes (see, for example, Banerjee et al). But a combination of significant network effects and large economies of scale and scope, such as we suspect are present in the JDY program, presents challenges for standard RCTs. It is relatively easy to see how small experimental trials may fail in cases where a programme of India’s size and scope might succeed.

Consequently, while it is a sample of one, in our view the Indian experiment is one that deserves far more study and attention from researchers, policy think tanks and international organisations. Indeed, Chopra et al remind us of the dictum of Frame and White, who in 2004 assessed the empirical literature on financial innovation as Mark Twain might have: “Everybody talks about financial innovation but (almost) nobody empirically tests hypotheses about it.” We hope that India’s programme to provide hundreds of millions of people with access to the financial system will change that!

Acknowledgement: The authors benefited greatly from presentations of the Agarwal et al and Chopra et al papers at the recent IIM Calcutta-NYU Stern India Research Conference.

This piece was first published on www.moneyandbanking.com and is credited to Cecchetti and Schoenholtz. Only changes in grammar and style were made prior to republishing the content.