RBI’s High Payout To Government Was No Favour: It Merely Made Amends For Earlier Short Payments

The RBI is obliged to maintain some predictability in dividend payments, and the short payments in 2016-17 and 2017-18 are what are being compensated in the 2018-19 accounts.

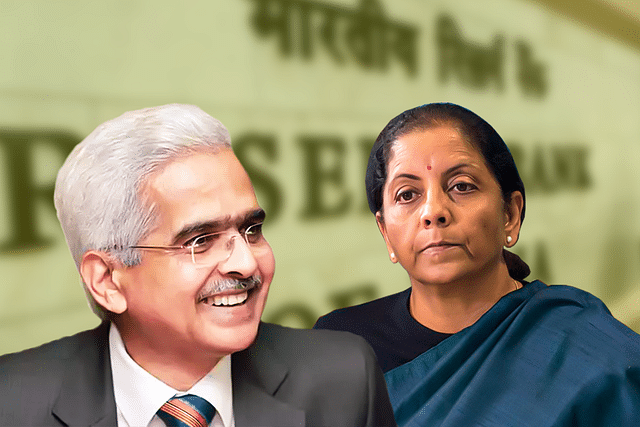

The Reserve Bank of India’s (RBI’s) decision to transfer Rs 1.76 lakh crore to the government as dividend for 2018-19 is seen as some kind of special favour done under pressure.

However, a closer look at trends in dividend payments and earnings shows that this level of transfer is not extraordinary.

Let’s first look at dividend payment trends in the last five years. In 2014-15 and 2015-16, the RBI paid Rs 65,896 crore and Rs 65,876 crore as dividends to the government – a total of Rs 131,772 crore for these two years. But in the next two years, dividends were cut back dramatically to Rs 30,659 crore and Rs 50,000 crore, before being raised to Rs 175,987 crore in 2018-19. (see table)

This cut-back in the previous two years was attributed to the higher costs incurred by the RBI in handling demonetisation (note-printing, etc) in 2016-17 and beyond.

But if you compare dividend payouts in 2014-15 and 2015-16 and the next two years, the short payments to government work out to Rs 51,113 crore, assuming the previous level of payouts had to be maintained.

This short-payment is roughly the same as the Rs 52,637 crore paid in 2018-19 by bringing down reserves, especially contingency fund reserves, which came down from Rs 2.23 lakh crore in 2017-18 to Rs 1.96 lakh crore in 2018-19.

The total payout for 2018-19 of Rs 1.76 lakh crore includes the year’s surplus of Rs 1.23 lakh crore, plus the reduction in the contingency fund reserves of over Rs 52,000 crore – which was written back into the profit and loss account as “other income”, from provisions no longer required.

The vast bulk of income surplus – the Rs 123,414 crore – came from a huge expansion in the bank’s balance-sheet from Rs 36.17 lakh crore to Rs 41.02 lakh crore, and consequent increase in interest earnings. Interest earnings soared by 44 per cent from Rs 73,871 crore to Rs 106,832 crore in 2018-19.

In short, the overall transfer of Rs 1.76 lakh crore was largely the result of a massive expansion in interest income and compensation for the short payments in 2016-17 and 2017-18.

There was actually no special favour shown to the government. Clearly, the culprit was the RBI board under Urjit Patel, which arbitrarily reduced dividends in the two years preceding 2018-19, when it could have maintained payments by digging into reserves at that time.

There was no need to penalise the government just because the cost of handling demonetisation was high. The RBI is obliged to maintain some predictability in dividend payments, and the short payments in 2016-17 and 2017-18 are what are being compensated in the 2018-19 accounts.