This Is A Good Budget

The Budget is in the direction of fulfilling the mandate of the Modi government

Long in anticipation, this first full budget of the Modi Government has brought together many of the promises of the electoral campaign with the traction of delivery. The Indian media did not take too long before dubbing it a Super Budget.

The key take-aways are in terms of growth with jobs, both rural and urban, combined with development of infrastructure that should boost the GDP by at least 3%. In fact, the GDP is expected to be at 7.5% in 2015, going up to 8.5% in 2016, and on to double- digits on a sustainable basis, thereafter. And even at the projected 7.5%, India becomes the fastest growing economy in the world, albeit on one-fifth the base of China.

Similarly the fiscal deficit, maintained at 4.1% this year, is projected to reduce to 3% over the next three years. The Current Account deficit, presently at 1.3% , is likely to go into a surplus perhaps in the course of the latter quarters of 2015 itself.

The Consumer Price Index (CPI) is expected to be contained within 5%, and inflation being a major obsession with the RBI, may prompt it to start cutting interest rates afresh very soon now. Industry would like to see it reduce by at least 400 basis points, or 4%, in the course of this administration, with the first 1% in 2015. Let us see if these wishes do become horses to do their bit for the revival of the investment cycle.

The economy may not be roaring like a ‘tiger’, as yet, as Arvind Subramanian put it yesterday while presenting the annual Economic Survey, but it is headed that way. Subramanian too spoke of double-digit growth, and being in a ‘sweet spot’, caused in some measure because of soft petroleum prices and global deflation.

In the Budget, a crack-down on black money, held domestically and abroad, with jail terms of up to 10 years, and punitive 300% penalties, was announced. The parallel economy may now think it wise to start merging with the official one. Benami property buying too will be fraught with danger because the Government intends taking a very dim view of it.

There is also some talk of a voluntary disclosure scheme coming up before the necessary laws are enacted, and this may provide a new revenue stream to the cash-strapped Government. The Centre now only keeps 38% of Government revenues, while the States, in line with Modi’s emphasis on greater autonomy and federalism, get 62%.

Incentives have also been announced to monetize an estimated 20,000 plus tonnes of gold held in private hands, via Gold Bonds, India’s own gold coins with the Ashok Chakra motif, Government administered loans against physical gold etc., all designed to tap into this massive resource for the benefit of the economy.

Individual PAN will now be recorded for transactions above Rs. 1 lakh. This flavour of accountability is continued with the corporatization of ports with their substantial land banks, and disinvestment, including loss-making PSUs, to the tune of $6.7 billion.

There is a push to deepen the debt market to boost the foreign investment under all heads from its present $ 55 billion, and grow it manifold. There is a bankruptcy law coming up and A Debt Market Board with greater integration with SEBI.

The Government itself will be investing an additional Rs. 70,000 crores into infrastructure and raising far more via a slew of newly announced tax free bonds. There is also a $ 40 billion ambition for Defence, including ‘Make in India’ for the sector, but this will have to be enhanced considerably, in both money and technology terms, by foreign collaborators.

There is also the long and somewhat detailed emphasis on integrating the facilities for Bharat with those offered to India. For the first time ever, there is a real effort to establish a universal social security foundation for the poor, inclusive of health insurance, life insurance and a pension.

Foreigners, who are expected to put in the big money much beyond what this budget can afford, are delighted. This is nearly comprehensive and forward looking, a growth budget coming from the one ‘bright spot’ in the global economy as international rating agency S&P put it.

A prospective, as opposed to retrospective, GAAR has been kicked down the pike by 2 years at least. The UPA’s Direct Tax Code has been mined for its gems and given a quiet burial. GST, the indirect tax structure that will both raise the revenue intake and reduce corruption and evasion, will be implemented by April 1, 2016.

Wealth Tax stands abolished. Corporate taxes will be reduced from 30% to 25% over the next four years. Income tax exemptions have been raised to add up to Rs. 4.42 lakhs if availed in full. This, after the tax slabs themselves were raised in the ‘half-budget’ of June 2014.

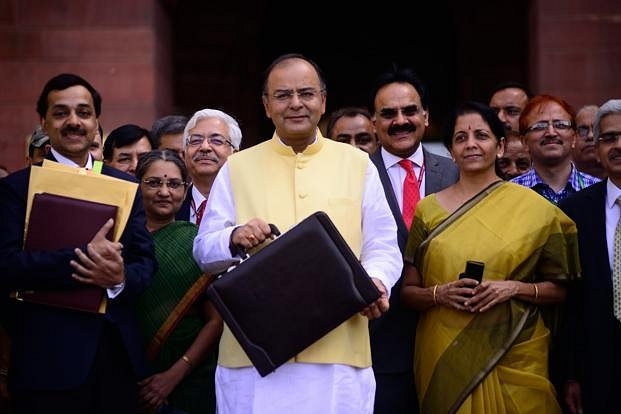

Almost every section of the Indian public has been addressed including the disabled. The emphasis on pensions for the poor is part of what Finance Minister Arun Jaitley called ‘Banking the unbanked, funding the unfunded’. The abolition of the essentially vindictive Wealth Tax, a dinosaur from classic socialist theory, in favour of a modest surcharge of 2% for taxable income above Rs 1 crore per annum is a sagacious move.

A greater emphasis on health care for the middle class with an exemption of premium of Rs.25,000/- up from Rs. 15,000/- recognises the increasing cost of private healthcare run for profit.

In welfare schemes, the laudable approach is to cut leakage and not the subsidy itself via massive direct transfers and digitization. Old UPA flagship schemes like MNREGA to provide minimum employment for the rural poor, have not only been continued but funded generously.

Rural credit has been enhanced right down to the micro level and the vast post-office network across the country has been pressed into service as a ‘payment bank’. The mission to provide housing for all has been given definition by specifying 2 lakh urban homes and 4 lakh rural homes of about 800 sq.ft size that will be built by 2022, all with round-the-clock water and electricity, and access to a road.

Mostly stable indirect taxes, have however been augmented with a consolidated Service tax at 14% up from the earlier 12.36%.

Tourism, long on its indifferent growth path, was vastly boosted in 2014 with Modi’s initiative to allow 43 countries to avail of a visa on arrival. This is now going to be enhanced to 150 countries.

Ease of doing business is demonstrated by consolidating 14 different clearances required at one window.

Higher educational institutions and health facilities have been announced, with special care to target those states where the BJP expects to make new inroads, such as Assam, West Bengal, Orissa, Bihar, as well as those where a thank-you is in order, such as Arunachal Pradesh and J&K.

Youth loans, R&D, clean energy, incentives for the local electronics industry, the laundry list is long and deep, but it has to said: This is a good budget.