Why The Jio Deal Makes Sense For Reliance And Facebook But Should Be A Matter Of Concern For India

Is the Jio-Facebook tie-up aimed at creating an industry monopoly and a superapp?

A superapp, in short, gives you all the functionality you need: messaging, video calls, payment services, social media, loans, e-commerce, TV channels, etc., under one umbrella.

Once you enter its walled garden, you have no escape, for you are too invested.

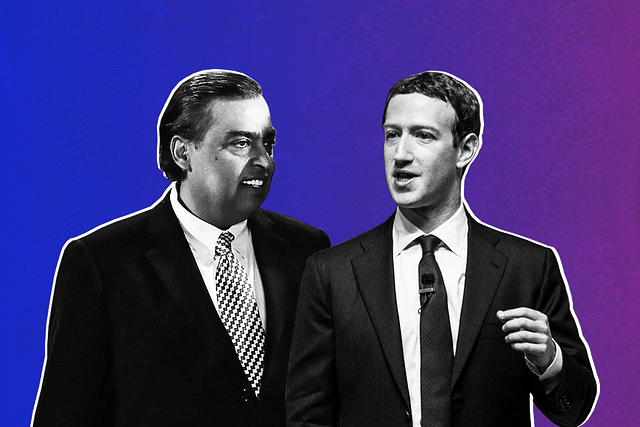

Facebook investing $5.7 billion for 9.9 per cent in Reliance Jio is, understandably, big news. It's worth analyzing who the potential winners and losers are in this deal, as well as any possible red flags.

Facebook has good reason to focus on the Indian market, as it is banned from China, and the India digital sphere is growing rapidly.

As Kanchan Gupta wrote for ORF, there surely is a case that the proposed deal is a vote of confidence in Digital India, and thus a good thing for India.

However, one could also be alarmed; not least because an Indian company with a prospect of becoming a global giant is, instead, selling out tamely to a foreigner.

The reasons may make eminent sense to the entrepreneur, but the sale may hurt the national interest.

For instance, PayTM is now merely an appendage to Alibaba, and all the Indian data they hold has already been plundered by the Chinese.

Flipkart is just an arm of Walmart.

Why the Jio deal makes sense for Facebook

India is Facebook and WhatsApp country. Almost all mobile users in India use one or both.

Facebook bought WhatsApp for $19.6 billion in a cash/stock deal (it became in effect $21.8 billion because Facebook stock appreciated), at $55 per user).

The obvious reason for the purchase was to capture new users, and eventually to monetize them.

Now Facebook is investing $5.7 billion in cash in 9.9 per cent of Jio (thus valuing Jio at roughly $57 billion).

By the same calculation, the Jio investment costs $16 per user, if you assume Jio brings 350 million users (the January 2020 Jio user base was 369 million 4G users, which is 32 per cent of India’s market).

Of course, it is apples to oranges, since Facebook is only a minority shareholder of Jio, not an outright owner as with WhatsApp.

So why is Facebook willing to shell out a fairly large amount per user in a market that is notoriously price-sensitive and frugal?

Jio’s ARPU/month was only Rs. 128 (under $2) in 2019, as compared to about $13/month for major US carriers.

The answer is that it has big plans. If, as pundits say frequently, “data is the new oil”, access to the detailed data of Jio customers will mean serious advertising revenues over time.

Besides, slicing and dicing that data will give them tremendous insights into consumer behaviour in the largest emerging market of them all.

Add in WhatsApp/Facebook users, and you’re talking some 600 to 700 million unique users.

Similar considerations brought rival Google into India too, among other things offering free Wifi access in hundreds of railway stations, partnering with RailTel to blanket India with fixed-line broadband, thus creating a pipeline through which to deliver content and suck up data.

Unfortunately, the Google Station deal seems to have gone sour, and may well be a casualty of Jio’s own widespread, inexpensive data footprint.

Now Facebook has a chance to one-up Google. Its WhatsApp has become the messenger app of choice, given the advantage of essentially free audio and video calls.

India is WhatsApp’s biggest market as well with some 300-400 million regular users. Even though Zoom has made a dent in the video market right, WhatsApp leads Facebook’s emerging market strategy.

This is not Facebook’s first foray into the Indian market. In 2016, TRAI cancelled its Free Basics program, which was zero-rated, that is, it gave access to Facebook and some other curated apps without eating into customer data allowances.

The casualty was net-neutrality as Facebook could pick winners by favouring certain apps (and build a walled-garden ecosystem).

Naturally, it was anti-competitive as well (Free Basics may not have survived the Jio tsunami of low-cost data even if TRAI hadn’t nixed it).

Given this history, why would Facebook want to try again? Several reasons: 1. WeChat, 2. Libra 2.0, and 3. Reliance’s lobbying power.

More about those in a bit.

Why the Facebook deal makes sense for Reliance and Jio

Even though Reliance became India’s biggest conglomerate through petroleum, it is now re-imagining itself as a digital firm.

The former is a sunset industry (West Texas Intermediate crude recently had May futures selling for negative $37.63 while the latter is a sunrise industry.

Reliance Jio has fundamentally transformed the Indian digital economy. India now has some of the lowest data prices, and some of the highest data utilizations in the world principally because Jio invested upwards of $25 billion in its 4G infrastructure and offered attractive pricing.

All of a sudden, Indians are data rich: instead of having to pay, say Rs. 1,000 for 2GB per month, we can get 1.5GB per day for no more than Rs. 200.

This has led to an explosion in data usage, although it’s mostly going for video downloads of Hindi cinema.

The impact of Jio’s inexpensive data and low-cost all-India calls has been electric. Consumers have flocked to the carrier. The cozy oligopoly of a few operators milking ARPU by flogging their aged 3G gear has been decisively disrupted, and the incumbents have not yet recovered from the shock.

The impact of Jio in the mobile data market is similar to the earlier impact of Reliance Telecom in the mobile voice market some years ago.

It was the latter’s relentless marketing and lowered entry barriers that caused a similar explosion in usage and created a mass market.

However, sadly, Reliance Telecom faded, and was not itself a major beneficiary.

Reliance Jio is not going to fade away, and it intends to capture some of the value it created. It is possible that Jio will benefit disproportionately from the Facebook deal, and I hope that is the case.

I personally would like Jio to become an Indian champion, a global player, like Alibaba and TenCent have become two of the most valuable companies in the world by exploiting monopoly access to Chinese data.

There is another issue. Reliance had been counting on a massive infusion of capital from Saudi Aramco, thus effecting a neat segue from oil to digital by offloading some petroleum assets to pay off large debts incurred by Jio (the stated goal was to make Jio debt-free).

The deal is for the sale of a 20 per cent stake in Reliance’s refining and petrochemicals business for $15 billion valuing all of Reliance at $75 billion.

Unfortunately, this Aramco deal seems to be in the doldrums after the Wuhan Coronavirus pandemic. When last heard of, the deal was in danger to miss a March 31, 2020 deadline, and so it did.

With oil prices plummeting, it is no longer clear that the Saudis will have the appetite for this.

On the other hand, Facebook is sitting on a huge cash pile: $52 billion at the end of 2019 and so its Jio deal is only 10 per cent of its war chest.

There’s plenty more to go around for other initiatives, for example 5G. If competition czars clear it, this deal can go through quickly.

Thus, from Reliance Industries’ point of view, the Jio deal is sensible. Besides, it is possible that they have a strategy for coming out on top: sort of a tail-wagging the dog scenario.

Reliance Retail has 11,300 stores. It can structure its Jio Mart e-commerce operations to cooperate with small neighborhood kirana stores (which incidentally have proved their lasting worth to regular customers during the coronavirus episode) and use a hub-and-spoke logistics model.

Jio has unveiled plans for digitizing millions of small businesses with its MPoS (Merchant Point of Sale) systems with a Rs. 3000 cost of entry compared to much higher rates from competitors.

This could be a disruptive innovation in retail, posing a challenge to Amazon and Flipkart/Walmart. The first salvo has already been fired, with Jio Mart already live on Whatsapp in test markets in Mumbai.

Why the deal could hurt India and Indians

There are at least four reasons why India should be concerned about the deal. These have to do with data privacy, payment platforms, digital currencies, and comprehensive superapps.

Activists and analysts have been concerned about data privacy (and related cybersecurity issues) for some time. There is the draft Data Security Bill 2019 that is currently tabled in Parliament. It is clear that India needs something comparable to the General Data Protection Rules (GDPR) that European countries have implemented.

There are two simple reasons: Indians do have a legitimate right to protect their data from the prying eyes of potentially malevolent authorities, and even more so from avaricious foreigners.

Secondly, it is imperative to firewall off Indian data. China created 7 out of the top 30 Internet companies in the world by preventing American Big Tech from accessing the data of Chinese consumers.

A Jio-Facebook tie-up (along with the existing Whatsapp, Instagram and Facebook Messenger presence in India) may well mean that efforts to contain the leakage of Indian data to overseas firms will be thwarted.

As it is, in addition to the aforementioned PayTM and Flipkart data, consumer credit data firm CIBIL, originally owned by a consortium of Indian banks, is now owned by an American firm, TransUnion.

And Facebook has been consistently accused of a cavalier attitude to consumer data privacy.

It is possible to argue that the Data Security Bill 2019 is an instance of closing the barn door after the horse has bolted.

That is, Indian data is already gone, and nothing can be done about it.

We might as well face the music. Given Reliance’s clout (for instance, 4G was once supposed to be data-only, no voice), it is possible that the Jio relationship will give Facebook unfettered access to Indian data.

On the other hand, it can also be argued that the Jio-Facebook deal is inherently anti-competitive, as it will reduce choice.

As it is, the number of mobile operators, after once having numbered in the dozens, has now shrunk to just four: Jio, Airtel, Vodafone-Idea, and BSNL.

The last two are struggling, and with the support of Facebook’s war chest, Jio might emerge as a monopoly telecom carrier.

And we all know what happens to consumers faced with a monopoly telecom carrier. We remember how BSNL acted: “We are the phone company, we don’t care”, as in the Lily Tomlin skit skewering monopolist AT&T in the 1980s.

The UPI/BHIM payments platform is another possible casualty of Jio-Facebook. The Universal Payments Interface is an efficient money transfer and settlement mechanism, and it is getting increasingly popular.

It crossed 10 billion transactions by the end of 2019, and surely with its advantage of being ‘no-touch’ (no need to physically handle cash or cards) it must be surging in volume in these Covid-19 times.

UPI is also fully homegrown, so that some concerns about privacy and data leakage abroad may be moot.

However, the Reserve Bank of India (RBI) in February 2020 released draft guidelines for a New Umbrella Entity (NUE) for retail payment systems, that will compete with NPCI, the public-sector owner of UPI.

It’s not clear why the RBI wants a new entity in retail payment systems, but the rules under the draft guidelines suggest that Jio-Facebook could well create a private-sector entity that can win the NUE competition.

That is cause for concern, especially as another part of the group (Jio Mart) is a player in the retail payments market: conflict of interest.

There is another concern, about digital currencies. Facebook, with fanfare, launched a blockchain-based digital currency named Libra in 2019. (They carefully distinguish it from a ‘crypto-currency’ like Bitcoin).

It was supposed to be a new global payment system, with heavyweight partners including Visa, Mastercard, ebay, Paypal etc.

However, most of them have exited the partnership and Libra appears to be floundering.

But Facebook is unlikely to give up, and surely a Libra 2.0 is in the works. In addition, the Chinese central bank rolling out its own digital currency to Alibaba, TenCent etc. The RBI needs to be afraid, very afraid, that control of the rupee may slip out of its hands in this digital battle.

The final, and perhaps most intriguing, possibility is that Jio-Facebook could create an invincible superapp. A superapp offers an integrated ecosystem or platform under one roof.

In other words, it gives you all the functionality you need: messaging, video calls, payment services, social media, loans, e-commerce, TV channels, etc., from a number of partners.

Once you enter its walled garden, you have no reason to try alternatives; you cannot exit either, because you are too invested in this ecosystem.

TenCent’s WeChat is the best example of such an addictive environment. It has a billion users, is ubiquitous in China, and is, alas, also used by the Chinese government for its Panopticon surveillance. Alibaba has something similar in Alipay.

Jio is the Indian entity best placed to create such a superapp for India, and it would be distressing if it were to end up as merely a channel for Facebook’s superapp, thus capturing little of the underlying value.

The opportunity lost is this: a superapp it controls could vault Jio’s into the list of top-25 global internet companies.

Instead of $57 billion, Jio could well be worth $500 billion (TenCent’s market cap)!

Combining Jio’s reach, Jio Mart and Facebook’s properties such as Messenger, Whatsapp, Instagram and some third party apps could easily create a superapp, especially if it also includes UPI or NUE.

This might mean Facebook has captured the Indian market in toto. That would be an amazing return on investment for its original $5.7 billion.

And that’s precisely why the Indian regulators, competition commissioner, and politicians all need to take a very close look at this proposed investment.