All UPI Apps Must Be Able To Scan BharatQR Codes, Says Government

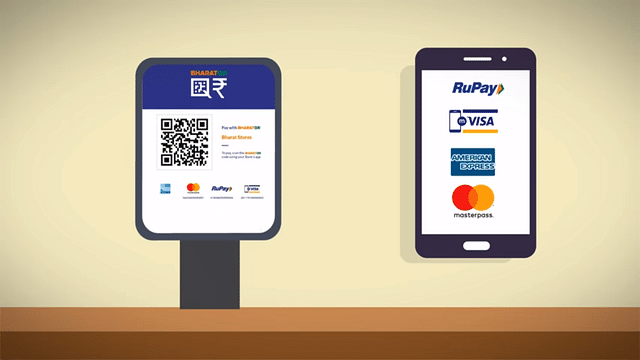

Aiming to give a boost to quick response code (QR code)-based transactions, the National Payments Corporation of India (NPCI) has mandated that all mobile applications that use the Unified Payments Interface (UPI) support the BharatQR platforms for merchant transactions.

A notification was released by the NPCI on Friday (16 March) giving a deadline of one month (till 16 April) to implement BharatQR, failing which transactions could be declined for non-compliance. Other mandatory requirements in the notification said that all UPI-enabled apps should be able to transfer funds to any other UPI virtual payment address (VPA), respond to all UPI collection requests and the ability to scan and generate both UPI and BharatQR codes.

UPI was launched by the NPCI in mid-2016, built atop the existing Immediate Payments System (IMPS) to allow bank-to-bank transfers using a smartphone. The Bharat Interface for Money (BHIM) app was launched in early-2017 for banks that did not have their own native UPI app.

NPCI’s directive comes in the light of global messaging platform Whatsapp launching payments using UPI in India. Whatsapp’s launch met with criticism from Paytm founder Vijay Shekhar Sharma who accused the Facebook subsidiary of flouting NCPI norms and limiting the the service to its own users. In response, the NPCI had issued a statement that Whatsapp had received their consent for a UPI launch limited to 100 million users with restrictions on the number of transactions. It also added that only after the app satisfies all the conditions would it be able to get a full-fledged launch.

Also Read:

NPCI: The Little Known ‘Start-Up’ Behind India’s Cashless Revolution

Forget Cash, Cheques And ATMs; With UPI, Your Mobile Will Be As Good As A Bank