Budget 2021 Banking Sector: Rs 20,000 Crore Capital Infusion; ‘Bad Bank’, Strong NCLT Framework To Address NPA

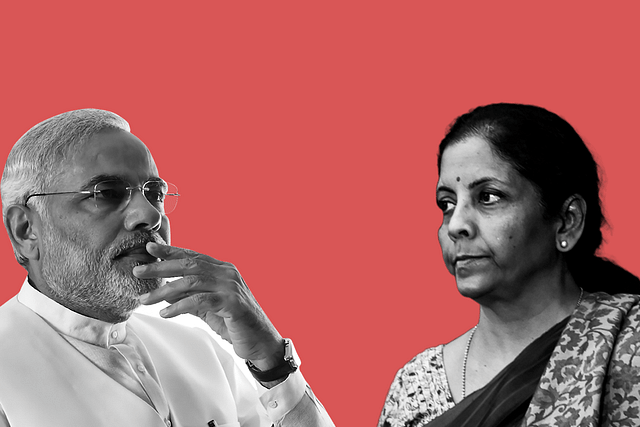

After years of deliberation, the PM Modi-led union government has finally decided to set up a bad bank to deal with the challenge of non performing assets in the banking sector.

Finance Minister Nirmala Sitharaman announced that a ‘Bad Bank’ - a new asset reconstruction and asset management company - will be set up to take over bad loans.

Alongside, a Rs 20,000 crore equity infusion has been announced for public sector banks.

The government plans to further strengthen the NCLT framework and continue with the e-court system for faster resolution of bad debts. A separate framework for MSMSe will also be made by the government.

According to an Indian Express report, these measures are expected to strengthen the state-owned banks and hasten the process of clean up of their balance sheet. The separate framework may help MSME owners, which have not been able to earn enough during the fiscal, and are likely to be taken to insolvency by their creditors, avoid losing their company while continuing to pay the debt.