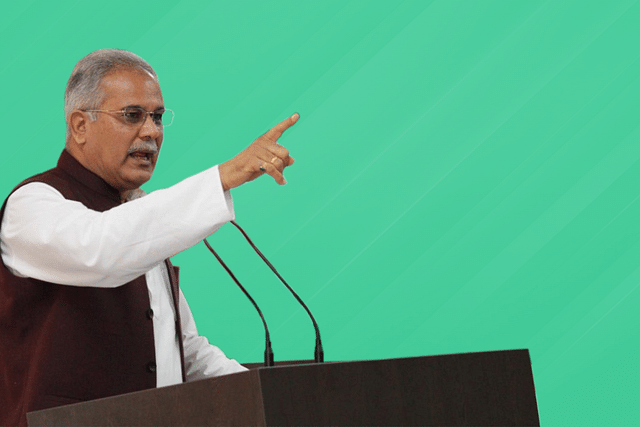

Chhattisgarh CM Writes To 17 States To Seek GST Compensation Mechanism Extension From Centre For 5 Years

“I have written a letter to the chief ministers of 17 states urging them that a joint request should be made to the Centre to extend the GST compensation mechanism,” said Bhupesh Baghel in a tweet.

Chhattisgarh Chief Minister Bhupesh Baghel has written a letter to his counterparts in 17 other states, including five ruled by the BJP and AAP-governed Delhi, seeking their support in a bid to convince the Centre to extend the period of compensation mechanism under the Goods and Services Tax (GST) for five years beyond June 2022.

The Congress leader on Sunday wrote in this connection to the CMs of Maharashtra, Jharkhand, Rajasthan, Punjab, West Bengal, Odisha, Andhra Pradesh, Telangana, Tamil Nadu, Kerala, Delhi, BJP ruled states- Madhya Pradesh, Uttar Pradesh, Gujarat, Karnataka and Haryana - as well as Bihar, where the saffron party is a ruling alliance partner.

In a tweet on Sunday night, Baghel said, 'The Union government has decided to stop the compensation given to states under GST after June 2022. The move will cause a huge loss of revenue to the manufacturing states. We had requested the Centre to continue with the GST compensation or make an alternate arrangement.'

“I have written a letter to the chief ministers of 17 states urging them that a joint request should be made to the Centre to extend the GST compensation mechanism,” he added.

Baghel said for manufacturing states, including Chhattisgarh, not receiving the GST compensation would be a big financial loss.

'Being manufacturing states, our contribution to the growth of the country's economy is much higher than those states which have benefited from the GST regime due to higher consumption of goods and services,” he said.

If the GST compensation is not continued beyond June 2022, then Chhattisgarh is expected to face a revenue loss of approximately Rs 5,000 crore in the upcoming financial year, he claimed.

'Similarly, your state would also have reduced revenue receipts in the next financial year. It would become very difficult to arrange for a shortfall in funds for public welfare and development works,' the CM said to the CMs of other states.

He further said that after the introduction of the GST regime, the autonomy of states on tax policy has significantly reduced.

Therefore, to recover from the adverse impact of COVID-l9 on the economy and till the time actual benefits of the GST regime are realised, states with similar interests should jointly request the Union government to continue the current mechanism of compensation for at least next five years, or devise an alternate temporary mechanism to compensate for the shortfall in revenue, he added.