IT Department Allows Manual Filing Of Form 13 For Taxpayers Seeking Deduction At Lower Or Nil Rate

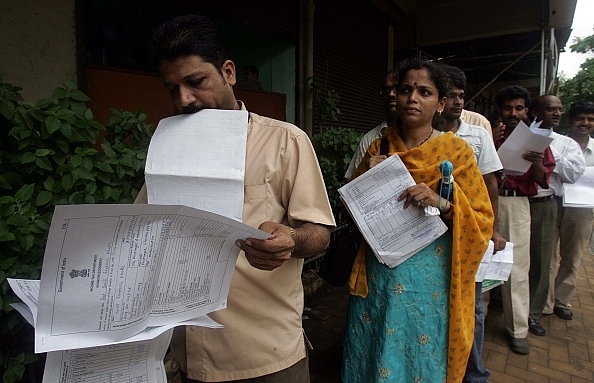

The Income Tax (IT) Department yesterday (Monday, 24 December) permitted resident and NRI tax filers to apply for tax deduction at a lower or nil rate manually, reports The Economic Times. The move is intended to provide relief to ease ‘genuine hardship’ being faced by certain taxpayers in filing Form 13 online.

As per the Income Tax Act, 1961, taxpayers have to apply for a lower withholding certificate with the assessing officer (AO) if they contend that their income tax deduction has to be made at a lower/nil rate.

These applications are to be made by the e-filing of Form 13.

As per a Finance Ministry statement, the IT Department has allowed NRIs to submit their manual applications to TDS officers or at ASK centres up until 31 March 2019. The date for resident taxpayers to submit Form 13 manually is till 31 December 2018.

According to Nangia Advisors LLP Partners Suraj Nangia, the directive has been released to remove the hardships being faced by some individuals in the shift from manual filing to e-filing of Form 13.

"However, the deferment of online filing of Form 13 is just for NRIs and not the other category of non-resident taxpayers viz. companies or LLPs. Further, relief for the resident taxpayers is only for a week, which implies that we may see many residents rushing to file their lower withholding applications till December 31, 2018," Nangia stated.