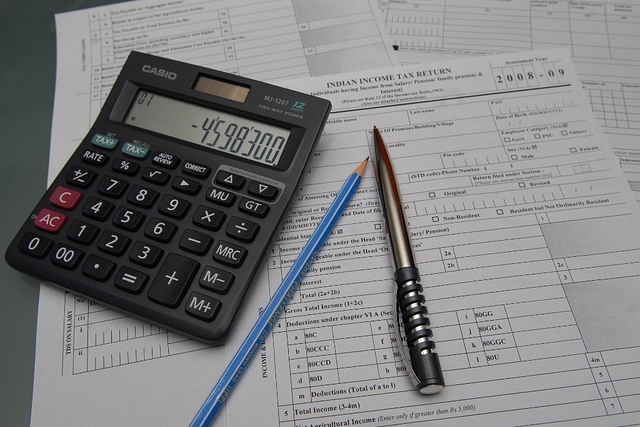

Last Date To File FY20 Income Tax Return Extended To 30 November; TDS Rate Reduced By 25 Per Cent

The Finance Minister Nirmala Sitharaman announced the extension of the last date of Income Tax filing for both individuals and companies for the Financial Year 2019-20 to 30 November 2020.

The last date for tax audit has been extended from 30 September to 31 October 2020. The Finance Minister also added that all the pending refunds for non-corporate businesses, professions and charitable trusts will be issued immediately.

Additionally, rates of TDS, for non-salaried specified payments made to residents, and rates of Tax Collection at Source (TCS) for specified receipts have been slashed by 25 per cent.

Contract payment, professional fees, rate of interest, rent, dividend, commission and brokerage among others will be eligible for the reduced TDS rate. This reduction will be applicable till 31 March 2021 and will increase liquidity by Rs 50,000 crore.