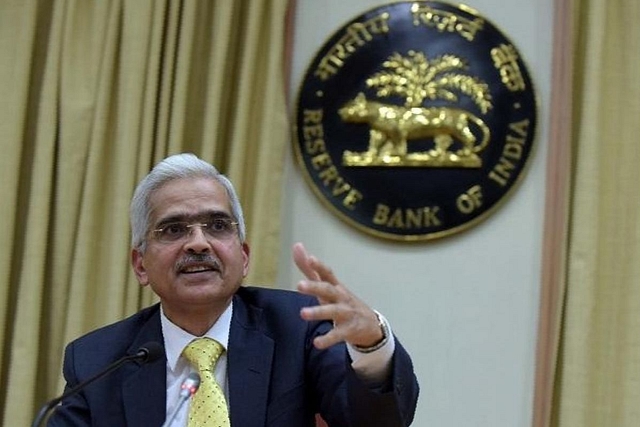

RBI Expected To Hold Key Policy Rates On The Back Of Inflationary Pressure And High Bond Yields

The Reserve Bank is expected to retain key lending rates on the back of inflationary pressure along with high bond yields during the first monetary policy review of FY22, experts contended.

Similarly, RBI's monetary policy committee (MPC) is likely to maintain the current accommodative stance due to growth concerns amidst resurgence of Covid-19.

In a poll conducted by IANS, economists and industry experts cited rising inflation as a key factor halting any further monetary policy easing.

"No change is expected in policy rate. Status quo is expected for the next 6-9 months," Sunil Kumar Sinha, Principal Economist, India Ratings & Research, told IANS.

"OMOs will also continue to stabilise the yields which have gone up after the government announced additional borrowing of Rs 800 in FY21."

Notably, the country's CPI based inflation rose to 5 per cent YoY in February from 4.1 per cent in January.

Likewise, food and beverage price growth gained 4.3 per cent from 2.7 per cent in January.

The core CPI excluding food, fuel and light was up 5.6 per cent in February, from 5.3 per cent in January.

"MPC in its upcoming meeting will continue to reaffirm the accommodative monetary policy despite the global increase in bond yields amidst concerns of a quicker than expected normalisation in the markets of developed economies," said Suman Chowdhury, Chief Analytical Officer at Acuite Ratings and Research.

"The upward pressure on G-sec yields is also driven by a sharp increase in sovereign borrowings and risks of higher inflation arising from the elevated retail fuel prices. While the MPC would need to take cognizance of these factors, it is expected to support the ongoing but nascent economic recovery by extending the pause on interest rates for a longer period."

According to Chowdhury, RBI is expected to manage bond yields within a corridor of '+/- 20 bps' from the current levels through the use of monetary tools including OMOs.

The Reserve Bank uses OMOs to regulate liquidity and bond yields via simultaneous purchase and sell government securities.

In contrast, rising Covid cases along with re-imposition of partial travel restrictions will deter the MPC from changing its growth boosting stance.

"The MPC will likely sound concerned both on the inflation and growth front. While the MPC would likely revise down the 4QFY21 inflation by 20-30bps, the risks of increasing input costs, higher commodity prices, seasonal upside in food prices and better pricing power could prod MPC to relook at its FY22 inflation forecast," said Madhavi Arora, Lead Economist, Emkay Global Financial Services.

"However, local lockdowns if persist, could impact services demand negatively and put downward pressure on 1QFY22 core inflation and could act as a balancing factor to emerging upside risks to inflation."

In the past week from March 29 to April 4, a Crisil note cited that daily cases shot-up from 68,000 to over 1 lakh - a whopping 52 per cent increase.

Furthermore, cases continue to be concentrated in Maharashtra, which accounted for 55 per cent of the new cases in March 29 to April 4 week.

Consequently, the rising cases, re-imposition of travel restrictions is expected to have a major negative impact on the economy.

"Average inflation is expected to remain above 4 per cent in FY22, suggesting an extended pause for the repo rate thru 2021. With the recent rise in Covid infections, uncertainty regarding the near term growth outlook has been reignited. Therefore, we expect the MPC to maintain the accommodative stance, at least for the next two reviews," ICRA's Principal Economist Aditi Nayar.

"Spurt in Covid cases and associated localised lockdowns have reignited uncertainty regarding the economic outlook. uncertainty may persist until after all adults become eligible for the Covid vaccines."

At present, the MPC of the central bank has maintained the repo rate, or short-term lending rate, for commercial banks, at 4 per cent.

Besides, the reverse repo rate was kept unchanged at 3.35 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 4.25 per cent.

"Considering the inflationary risks, the RBI MPC is expected to adopt a cautious approach and hold the repo rate at 4 per cent in the upcoming MPC meeting to be announced on April 7, 2021," Brickwork Ratings' Chief Economic Adviser M. Govind Rao said.

"Given the rise in the spread of Coronavirus and the imposition of fresh restrictions to contain the virus spread in the major parts of the country, the RBI is likely to continue with its accommodative monetary policy stance."