RuPay, UPI Are Conquering Market Share of Visa, Mastercard: Jaitley Lays Out Magnitude Of Their Ascent

Several global payment processors such as Visa, Mastercard have been losing out to domestic players like RuPay. This has led to Mastercard complaining to the United States’ Government about India’s protectionist policies, Deccan Herald reported.

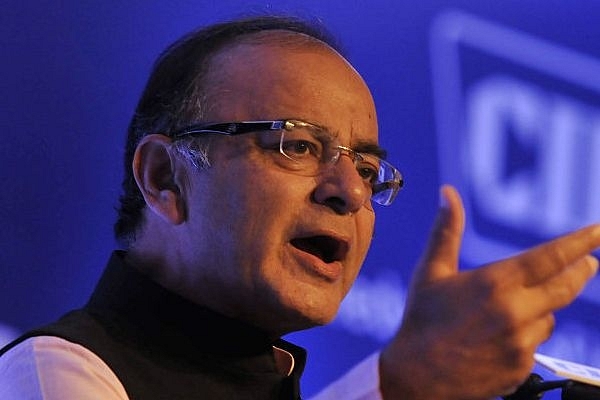

Finance Minister Arun Jaitley took to Facebook and wrote, “Today Visa and Mastercard are losing market share in India to the indigenously developed payment system of UPI and RuPay Card, whose share has reached 65 per cent of the payments done through debit and credit cards.”

He further added that the Unified Payment Interface (UPI) transactions have increased from Rs 50 crore in October 2016 to Rs 59,800 crore as of September this year. As far as Bharat Interface for Money (BHIM) transaction goes, it started from Rs 2 crore in September 2016 and has touched Rs 7,060 crore as of September 2018. The app is being used by 1.25 crore people across the country.

Among all the UPI transactions done in the country, BHIM holds a 48 per cent share among them as of June 2017. The RuPay card transactions has seen an upward growth from Rs 800 crore prior to demonetisation to Rs 5,730 crore as of September 2018 through Point of Sale (PoS). With respect to e-commerce purchases, First Post has reported that the number has increased from Rs 300 crore to Rs 2,700 crore.