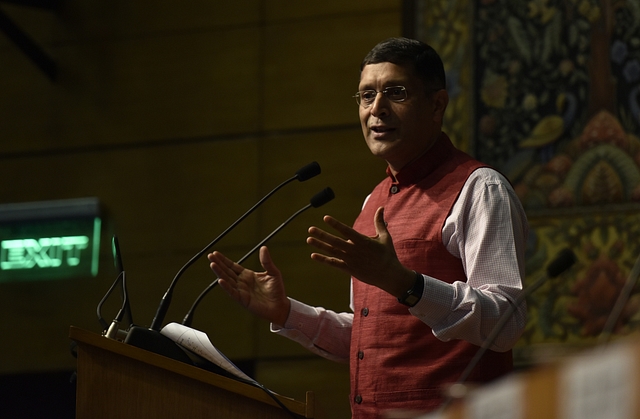

Why Arvind Subramanian Thinks 8.5 Per Cent Growth Rate Is Possible

Chief Economic Advisor to the Indian government, Arvind Subramanian has expressed optimism that growth rates of 8.5 per cent can return to the Indian economy, provided it can overcome the two challenges it now faces. These being weak demand, owing to the new tax regime and restrictions on cash transactions, and bad-loan ridden banks and corporate entities mired in debt.

In interviews to Economic Times and Livemint, acknowledging these challenges, Subramanian appreciated the government’s recent bank recapitalisation move which aims to do away with the bad loans situation. Also, he pointed to the rejig of institutional framework being undertaken by the Central government and the Reserve Bank of India (RBI) to resolve corporate bankruptcy. The weak demand issue should also resolve with time as the new tax regime gets naturalised.

Owing to the above steps, he conveyed positivity about corporate investment demand which would in turn stimulate the economy. He also called for more reforms in the banking sector to shrink risky loans, more public sector bank accountability and to promote greater private sector ownership.

Along with these reforms, he stressed on the incentivising voluntary tax compliance as opposed to cracking down on entities in case of non-compliances which ultimately leads to a rise in the cost of doing business, adding uncertainty to businesses. He called for a rethink for the way policy is shaped with regards to taxation.

Speaking of the new Goods and Services Tax (GST) regime, he indicated that several reforms were in the pipeline, including collapsing of the 12 and 18 per cent tax slabs into one. He also said that it was a matter of time before more commodities like land, realty and natural gas were brought under the new regime, thereby expanding the tax base. He also conveyed steps that were underway to review the tax filing system to make it simpler and more practical for everyone.

Conveying optimism about the federal polity of India, he called GST as the harbinger of increase in cooperative and competitive federalism in India and expressed confidence in the direction it’s headed. He also said that he was pleasantly surprised by the number of registrants and the implied tax base in the next six months which was already bigger than what they had estimated before the GST regime was implemented.