India’s Forex Reserves Swell By $5.27 Billion To Record High Of $598.16 Billion; Liquidity May Further Drive Stock Markets

India’s foreign exchange reserves jumped up by around 5.271 billion dollars to touch a record high of 598.165 billion dollars during the week ending 28 May, the data from RBI showed.

According to the Reserve Bank of India (RBI)’s weekly statistical supplement, the reserves rose from the previous week's $592.894 billion to $598.165 billion this week.

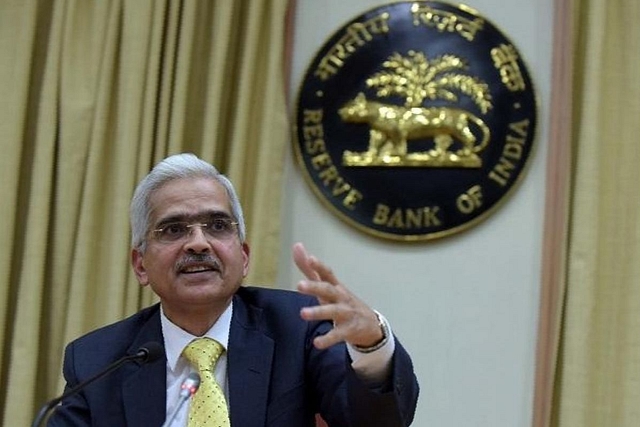

Announcing the second bi-monthly monetary policy review earlier on Friday, RBI Governor Shaktikanta Das had stated that the country's forex reserves may have crossed $600 billion currently, reported Mint.

"Based on our current expectations, we believe that our (forex) reserves have already exceeded USD 600 billion. That is something which gives us a great amount of confidence to deal with the challenges arising out of global spillovers, should they happen at a future date," Das said.

India’s forex reserves comprise foreign currency assets (FCAs), gold reserves, special drawing rights (SDRs), and the country’s reserve position with the International Monetary Fund (IMF).

On a weekly basis, FCAs, the largest component of the forex reserves, edged higher by $5.01 billion to $553.529 billion.

Expressed in dollar terms, the foreign currency assets include the effect of appreciation or depreciation of non-US units like the euro, pound, and yen held in the foreign exchange reserves.

Meanwhile, the value of the country’s gold reserves increased by $265 million to $38.106 billion

In addition to these, India's reserve position with the IMF declined by $5 million to $5.016 billion in the reporting week. Also, India's special drawing rights with the IMF increased by $2 million to reach $1.515 billion.

As India's forex reserves cross the $600 billion mark, there are indications that the ample liquidity, both globally and in the domestic space will continue to drive the Indian stock markets.

"The success of these efforts is reflected in the stability and orderliness in market conditions and in the exchange rate in spite of large global spillovers. In the process, strength is imparted to the country's balance sheet by the accumulation of reserves," RBI Governor Shaktikanta Das added.

Experts say foreign exchange reserves have topped $600 billion and more than $105 billion this year alone indicating huge liquidity in the system.

The average daily turnover in NSE is about Rs 79,000 crore in May 2021 as against Rs 65,000 crore in 2020 and only Rs 36,000 crore in 2019. Experts said investments by the young set are spiking and the boom in markets is not going to ease off any time soon.

With IANS Inputs