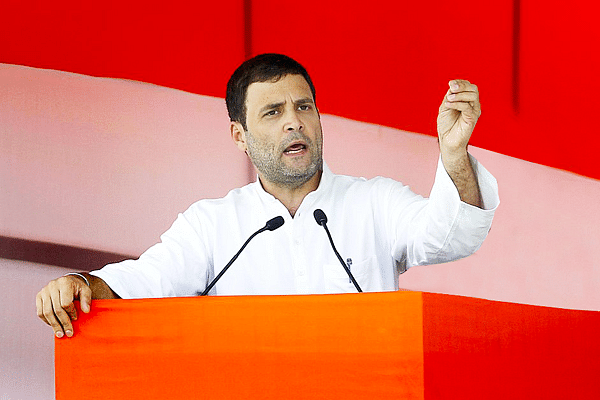

50,000 Chinese Jobs Vs India’s 450? Where Rahul Gandhi Misleads In Job Creation Argument

Rahul Gandhi is not wrong when he says that the BJP-led NDA government has managed to create merely 450 jobs against China’s 50,000 every day.

What the Congress president, however, doesn’t see is the trap that the Chinese economy has gotten itself into, in creating jobs the way that it has.

“China gives jobs to 50,000 people a day, the BJP to 450,” claimed Congress president Rahul Gandhi today (20 July) in Lok Sabha. Blaming Prime Minister Narendra Modi and the National Democratic Alliance (NDA) government for unemployment in India, Gandhi cited China’s job growth for comparison.

Gandhi is not entirely wrong. Creation of 50,000 jobs every 24 hours amounts to 18 million jobs created each year. China’s building boom, increased investments with the help of state-owned enterprises, easy availability of credit, and other factors have facilitated the creation of enterprises overnight, thus ensuring job creation in millions. In early 2017, a report in the Economic Times had said that 13 million jobs were created in China in 2016 alone.

But half knowledge is a dangerous thing. Incomplete facts may make for engaging Parliamentary theatrics, but it doesn’t present the full picture. Gandhi talked about the 50,000 jobs being created every day, or 180 by the time you complete reading this article, in China. But what the Congress president does not understand is the implications that that may have for the Chinese economy.

Now, where do these Chinese jobs come from? The country has used more cement between 2011 and 2013 than America has done in the twentieth century, and thus, a few million jobs were available in the construction sector alone. To add to that, there have been thousands of real estate companies across China engaged in building residential spaces, business parks, and replicas of cities like Paris and London.

After the recession of 2008, China was able to manage investments from abroad for its projects. It also launched a massive economic stimulus to boost lending and consumer expenditure, and this was done through state-owned banks with little regulation in place. This led to an accumulation of debt. Since 2008, the Chinese have added a cumulative debt of $12 trillion, as much as the size of the American banking system. The debt-to-gross domestic product ratio has gone from 160 per cent in 2008 to 260 per cent by the end of 2016.

So, where were these 50,000 jobs, or a job every two seconds, created?

First, some of them were created only on paper. While this share of the number may be a small percentage of the total jobs created, it reflects the fraudulent practices that have sustained the hype around the Chinese economy. Many were floated on the Wall Street in the United States to fool amateur investors. Even the Chinese regulatory authorities refused to act against the false revenue figures stated by most of these companies.

From green energy to semiconductors, these companies claimed expertise in many domains. For instance, a mining company by the name of Silvercorp produced 35 per cent and 75 per cent less ore and silver, respectively, than what it told its investors. Another company, claiming to be a million-dollar logistics setup, had only one truck and 40 employees. There was another company claiming to usher environmentally friendly energy practices by mixing water with coal.

These companies were a source of tax for the local government and, hence, were sustained unless exposed. However, given the absence of any free and independent press, judiciary, or regulatory bodies, the companies sustained their existence. In most cases, the credit ensured that salaries were paid on time. When credit ran out, the company vanished overnight, only to reappear under a different form elsewhere, eager for more credit.

Fabricated data led to fake gross domestic product (GDP) figures for provinces. In 2016, it was revealed that the Liaoning Province of China had exaggerated its tax revenues by 20 per cent for three years. Eventually, it became the first Chinese province to end up in recession.

Employment was generated through excessive manufacturing too. Creating the world’s largest closed-die hydraulic press forge in 2014, China was well on its way to creating metal fragments stronger than what the US had or could ever create. There was only one problem. Whatever the forge could create, it was already being created by lesser-capacity forges, thus rendering it useless.

Assuming one has to start a company in India, they are required to pay market prices for land, plots, infrastructure, and other amenities. It is all done within a budget, which also helps the company decide the number of people it can employ. However, in China, companies were helped with subsidised credit, extended leverage, and other tax rebates, thus enhancing their capacity to employ people. Jobs were created, only to be sustained by unregulated lending practices and gradual debt with state-owned banks.

Today, China has ghost cities, with fancy business parks without any business, high residential buildings with no occupants, and endless highways with few travellers using it. These development projects have been sources of taxation for local governments, and hence, the leverage has been never-ending. Rural people were evicted from their lands only to be forced into labour for projects that today house nothing but debt.

In their enthusiasm to build, the Chinese, on an average, have added five districts for every existing city to create room for the imminent migration from rural to urban areas. However, banking on credit, the real-estate tycoons have been forced to price these accommodation units expensively. Thus, the houses in these new districts have ended up becoming unaffordable for people they were created for in the first place.

At the end of 2008, local governments in China were 5.6 trillion yuan in debt. In 2016, the debt increased to 16.2 trillion yuan ($2.5 trillion). One could argue that the debt for local governments in the US is $3.1 trillion. However, the US economy is greater than China by 45 per cent. China has exceeded its leverage and limitations in a gamble that will not pay off in the long run.

Thus, Gandhi is not wrong when he says that the BJP-led NDA government has managed to create merely 450 jobs against China’s 50,000 every day. What he, however, doesn’t see is the trap that the Chinese economy has gotten itself into.

Some may argue that it is necessary to extend credit to boost employment; but, to what extent?

China’s “50,000” figure may not remain forever, for the GDP is already showing signs of weakness, falling under 7 per cent. Household debt is rising, resulting in less spending. Ghost cities across the country are discouraging further construction, resulting in falling prices of commodities like steel and aluminium. Already, China’s President Xi Jinping is tightening his hold on the economy, bringing an end to the free run that lenders and borrowers have had all this time.

It is, therefore, not about creating 50,000 jobs, but about creating jobs that take the economy forward. Prime Minister Modi can sanction trillions of rupees in loans tomorrow through state-owned banks and generate 100,000 jobs a day for the months of January, February, and March, and boost overall employment percentage. But in so doing, he would wreck the economy for years to come. And Modi would know better than to do that.