Tech

Indian Semiconductor Expertise: All About Technology Transfer, Plus Need For An “Aatmanirbharta Index”

Dr Santhosh Onkar

Aug 21, 2022, 04:07 PM | Updated 04:07 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

How does a country acquire technology?

Two recent events form the backdrop for this article.

The first is United States (US) House Speaker Nancy Pelosi’s visit to Taiwan, riding on the back of the “CHIPS and Science Act.” The Act was passed by the US House to dedicate a sum of $52 billion with the aim to bring back semiconductor manufacturing to the US.

The second event is the revelation by American semiconductor analyst firm TechInsights that China’s top chip maker, Semiconductor Manufacturing International Corporation (SMIC), has cracked the 7 nm sealing for production of advanced semiconductor chips despite American restrictions to curb Chinese homegrown silicon manufacturing.

Even though the SMIC news can also be seen as part of a lobbying effort directed at US lawmakers to create some expediency for the domestic legislation, nonetheless, it is worth noting that SMIC claims to be the fastest to have reached the 7 nm node from 28 nm, in three years, entering risk production.

Oddly enough, Intel is still struggling with yield challenges at the same technology node (7 nm). Taiwan Semiconductor Manufacturing Company (TSMC) and South Korea’s Samsung are the only two players who have managed to advance further than 7 nm.

A curious reader may ask: Where does India begin? What does it take to acquire technology? How does one sustain technological excellence to become really “aatmanirbhar (self-reliant)?”

One way is “technology transfer.”

Why Technology Matters

Jan Fagerberg, after a quantitative study of 25 countries, concluded the existence of a close correlation between the levels of economic development and technological development in a country.

Technology policy should be seen as part of economic policy. Therefore, technology policy is concerned with wealth creation and not just the pursuit of technological achievement for its own sake.

The success of any technology is measured in the role it plays in the process of wealth creation. Therefore, any technical achievement can only be validated when it contributes to maximising economic benefits through the realisation of a new product successfully brought to the market or a new process successfully put into use.

This brings us to the question: How do we distinguish technical knowledge?

R C Mascarenhas tabulates them thus:

General knowledge in the public domain

Industry-specific: Technical know-how necessary to produce a product or to manage a process, which is generally known within an industry

System-specific: Know-how for the production of a specific product

Firm-specific: Knowledge owned and/or contained within a specific firm, used to produce a product or manage a process

Ongoing problem-solving capability: Embedded know-how gained as a result of experience and which is vital to solving production process problems

This distinction serves to identify proprietary technology that is usually protected in the form of patents and trademarks and the associated challenges in acquiring and absorbing it.

The other classification that is worth noting (based on the ease with which technology can be acquired, ramped up, and internalised) is core and ancillary technology.

Core technology is considered as vital knowledge that is protected and which enables manufacturing — it is complex and capital-intensive.

In semiconductor manufacturing, core technology translates to know-how in process recipes, process control and optimisation, yield engineering, root-cause production issues, and resolving defects with quick turnaround time.

Ancillary technology, on the other hand, is less complex and is common to several industries. In semiconductor manufacturing, this translates to embodied equipment, materials and engineering services like logistics, packaging, and assembly, and employing labour-intensive methods.

(Indian mainstream media and non-expert commentators are, unfortunately, prone to making the lazy and dubious generalisation where “chip packaging and assembly” is described as chip manufacturing.)

What Is Technology Transfer?

H Brooks attempted a broad definition of technology transfer (in National Science Policy and Technology Transfer, 1966):

“Technology transfer is the process by which science and technology are diffused throughout human activity. Wherever systematic rational knowledge developed by one group or institution is embodied in a way of doing things by other institutions or groups we have a technology transfer. This can be either transfer from more basic scientific knowledge into technology, or adaptation of an existing technology to a new use. Technology transfer differs from ordinary scientific information transfer in the fact that to be really transferred it must be embodied in an actual operation of some kind.”

How Is It Done?

R D Robinson lists 16 different mechanisms by which technology is commonly transferred (The International Transfer of Technology: Theory, Issues, and Practice, 1988). Frank Bradbury classifies these into two broad categories called vertical and horizontal (Transfer Processes in Technical Change, 1978).

Vertical transfers are generally intra-enterprise and involve incorporation of new scientific knowledge from an idea to its final development, or can also be an inter-transfer, for example, between a research institute and a manufacturer.

Horizontal transfers involve the transfer of proven and tested technology from one industry or country to be adopted, modified, or applied in another country.

Although vertical transfer of technology is the ultimate goal for recipients of a given technology who wish to be aatmanirbhar, early-stage countries (like India) who wish to achieve rapid development have the obvious choice of catching up by emphasising horizontal transfer of technology.

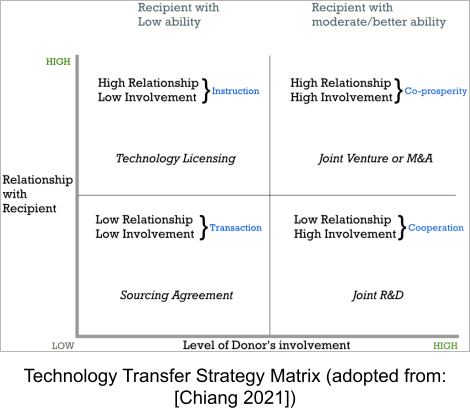

Yiteng Chiang outlines four themes (transaction, instruction, cooperation, and co-prosperity) based on his case study of Taiwanese electronics firms (Understanding technology transfer: an extended resource-based view, 2021). The four donor-recipient modes and corresponding dynamics are explained:

Transaction: In this configuration, the donor is obliged to fulfill the requirement of what to do and how to do it.

Both parties enter a “Sourcing Agreement” without deep involvement involving two aspects — a) Companies exchange manufacturing resources (facilities and equipment) and financial resources, b) Manufacturing service is consigned to partners who provide companies with finished (or semi-finished) products, subject to the specification designated by the companies.

Instruction: This configuration involves a closer relationship whereby the recipient lacks the specific skills required and the donor tends to engage in “Technology Licensing” without high involvement.

Recipients obtain the right to use the donor's proprietary technologies for their use (manufacturing, development, sales, and so on).

Cooperation: In this configuration, the donors benefit and, more so, they tend to have higher involvement. The interaction is under a mutually agreed goal and schedule to develop specific technology or production via a “joint R&D,” spreading the cost and risks among partners.

The aim is to realise shared benefits by combining financial and technological resources based on a portion of R&D (research and development) contributions (including intellectual property, development experience, research talent, and so on).

Co-prosperity: In this configuration involving a close relationship between both parties, donors are willing to make most decisions and take up most of the responsibilities, while donors enter a “joint venture” or “M&A” with high involvement to combine technological, manufacturing, distribution, and financial resources if recipients are experienced and possess the skill to perform the tasks.

Depending on the recipient’s abilities, licensing contracts range across — a) Early licensing before the technology is developed, b) Prototype licensing signed after the technology is developed, and c) Cross-licensing, enabling both to share patent rights to develop new products.

These modes (Instruction/Transaction) are primed for operational performance. When donors have higher involvement by means of cooperation, namely, a) custom co-design, b) joint specification definition, c) joint R&D projects, and d) subcontracts, donors seek strategic performance.

The crucial aspects that need to be ascertained regarding donors in a technology transfer activity are — a) Willingness to gain the recipient’s trust and confidence, b) Understand the recipient’s needs and adjust transfer methods accordingly, c) Solve problems, and d) Evaluate recipients’ abilities and apply the right strategy to work with them.

Some of the challenges that arise while transferring technology developed in advanced economies are in transmission due to knowledge gap, level of sophistication, disparity in industrial and technological infrastructure, cultural differences, and adoption and modification difficulties.

What India Lacks In Technology Transfer

Silvere Seurat writes: “One of the major problems faced by technicians from Western countries in India has been their impatience and frustration with Indian bureaucratic procedures, delays in decisions, lack of proper organizing and planning. Most of these technicians have limited encounters of specific duration and arrive without proper briefing or any understanding of the local culture. Greater emphasis is now being placed on training such technicians and bringing in intermediaries to act as “interpreters” etc.” (Technology Transfer a Realistic Approach, 1979)

Even though India has come a long way from this decades-old observation by Seurat, nonetheless, there are some systemic gaps that need tinkering for long-term technology self-sufficiency.

Need For An Aatmanirbharta Index

Most of the energy during erstwhile technology transfers has been focused on the regulation of technology flow, while it would be prudent to improve our capabilities in managing the transferred technology as well.

It is imperative that India develops expertise to assess the overall technology transfer strategy to make a clear distinction on the types of technologies (core or ancillary, example: fabrication vis-à-vis assembly), how far a technology has met with the goals of indigenisation, employment generation, income distribution, and its impact factor considering spillover due to second-order effects.

As the information age accelerates, shortening technology-driven disruptions, it would be shrewd to devise an “Aatmanirbharata Index” to benchmark our future efforts in pursuing critical technologies.

Academia-Industry Link And Resource Leveraging

The availability of skilled labour is an aspect that inhibits industrial progress and entangles the discourse on whether to import technology to suit the local skill base or to develop skills to the level of the technology.

The answer to this dilemma is the obvious choice of building skills, but Indian history is replete with examples of having taken wrong turns; for example, importing oil-based technology for fertilisers and railways instead of coal (which was readily available in India).

Any future firm that expects to thrive in India needs to rely on “resource leveraging.” In order to have quick turnaround time, employing resource leveraging needs a framework comprising public agencies, government departments and their institutional infrastructure, trade associations, inter-firm linkages, and collaborative engineering research associations.

The framework, originally developed by the Japanese and expertly imitated by the Taiwanese, is an accelerated national system of economic learning. India, unlike Europe and the US, which rely on attracting talent from all over the developing world, is forced to create and retain a talent pool. Establishment of a connected framework will go a long way in achieving the objective.

What About Market Pull?

R&D investment by the Indian industry is abysmally low. It is mostly dominated by family enterprises like the Korean Chaebols. If governments don’t pay attention to demand-pull policies like support for commercialisation of indigenous semiconductor technologies and related product markets and technology development, then Indian industry will continue to act as conduits finding tedious workarounds for import substitution without any appetite for adoption, absorption, and assimilation of technology.

They will continue to languish as glorified packaging firms dabbling in ancillary technologies with perpetual dependance on the import of core technologies without ever taking the pain of developing anything because it is readily available.

So, governments have to graduate from mere sloganeering and proceed to have dynamic policies for industry with tangible targets and focused roadmaps that are institution-centric and not people-centric.

Inter-firm Strategic Alliances And Quality Consciousness In SMEs

Even though technology transfer would kick-start an industry, without the establishment of company-to-company linkages to deepen competence and core-technology R&D, it would be a herculean task to produce new players and stimulate semiconductor industries.

While institutional support in the early stages of an industry is vital, we can’t discount long-term thrust on open-world competition where quality is key. Technology transfer cannot follow a piecemeal approach.

Traditionally, Indian experience in manufacturing has focused only on the initial phase of getting the manufacturing capability to the recipient with very limited subsequent vision.

The absence of engineering orientation like indigenisation of materials, equipment, and product and systems development has led to continued dependence on technology donors for further import.

Unlike the Japanese, the Taiwanese, and, of late, the Chinese, we have not explicitly identified technology development as a strategic objective for import substitution in electronics with clear breakdown translating into tangible goals.

Technology transfer management will play a critical role in determining our success. It is about time we take definitive steps in this direction if India wishes to stand on its own feet in semiconductor manufacturing and be counted.